How to Protect Assets from Medicare

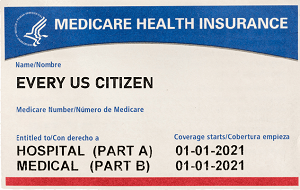

As we age, we start looking at end of life care more seriously. We know that when we turn 65, Medicare will kick in, and it will cover our doctor visits and prescriptions and hospital visits. However, when it comes to long-term care, what is Medicare’s role, and how do we protect our assets?

First, it is important to mention that there are often misunderstandings about how expensive long-term care is, and how it is paid for. Some people do not realize that their health insurance or Medicare will not cover the costs of long-term care, or that Medicaid will cover a certain amount of it, but only if they’re eligible.

Because Medicare does not generally cover long-term stays in a facility, they will not go after assets like your home. The costs of long-term care can be devastating, financially. This is why planning ahead is so important, even if it is an uncomfortable thing to think about. If long-term care is needed, Medicaid can kick-in, if the person is eligible. This is where things can get a bit confusing.

Medicaid can help to cover the cost of a nursing home, as most of us will run out of the money needed to pay for these facilities out-of-pocket. However, when the person dies, Medicaid will go after any assets they have in order to pay back what was paid out for the person, in a process called the Medicaid Estate Recovery plan. This can lead to dire situations for spouses or families who may find themselves having just lost a loved one, and dealing with Medicaid attempting to take the house in order to pay off the bill.

Advanced Planning

There are ways to protect your assets, however. Planning in advance is critically important, especially when you’d like to keep your home or assets in the family. Advanced planning will also allow you to avoid Medicaid’s five-year lookback, and avoid the penalty involved with that. It is best to try to plan five years ahead of any illnesses or health trouble you or your spouse may encounter. Of course, this is easier said than done, but the earlier the better.

Planning well in advance of any potential issues also gives you more options in terms of how to set up your estate planning to avoid things like the Medicaid Estate Recovery program.

Property Transfer

Transferring your property to an irrevocable trust can also protect it from Medicaid. While this can be more flexible than other means of protecting your assets, it’s also more complicated.

Some people decide to “deed” their home to their children. This can also trigger the five-year penalty lookback period, and leave you unable to pay for care. Using a trust is a better way to do it, in terms of risk avoidance.

These are also plans you should not come up with on your own. An experienced asset protection attorney, who has dealt with Medicare and the surrounding issues, is best suited to look at your individual circumstances, and work with you to develop a plan. An experienced attorney can also help put you at ease if you are worried about paying for long-term care, and keeping your assets.

Asset Protection Lawyer

There are options available to your specific circumstance, and an he caring asset protection lawyers at The Mattar Firm work with you for the best possible outcome for you and your family. Call us today at 239-222-2222 or 844-444-4444.